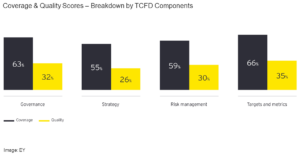

Companies are not required to disclose the information that investors need to price climate risk. Voluntary frameworks, like the Task Force on Climate-Related Financial Disclosures (TCFD), do not bring about the necessary change. This has led to mispricing climate risk and capital misallocation, which harms investors and delays the transition to net-zero carbon neutrality. This paper argues for mandatory corporate climate disclosures and suggests the regulatory architecture that supports such a disclosure regime. It outlines design principles to establish metrics against which government proposals can be evaluated in support of their efforts and to call out policy greenwashing.

Companies are not required to disclose the information that investors need to price climate risk. Voluntary frameworks, like the Task Force on Climate-Related Financial Disclosures (TCFD), do not bring about the necessary change. This has led to mispricing climate risk and capital misallocation, which harms investors and delays the transition to net-zero carbon neutrality. This paper argues for mandatory corporate climate disclosures and suggests the regulatory architecture that supports such a disclosure regime. It outlines design principles to establish metrics against which government proposals can be evaluated in support of their efforts and to call out policy greenwashing.

Armour, John, Luca Enriques, and Thom Wetzer. "Mandatory Corporate Climate Disclosures: Now, but How?". SSRN Electronic Journal. (x1636934400)November 15, 2021. https://doi.org/...

Posted on 19/11/21

Recent Abstracts

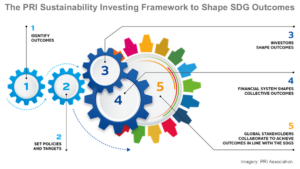

Investing with SDG Outcomes

Investing in the Sustainable Development Goals (SDGs) involves deploying investment capital in a way that has a positive impact on society and the environment while aligning the investments with the United Nations' 17 SDGs. Sustainable Development Investing (SDI) goes beyond traditional financial returns and seeks to ...

Posted on 22/04/25

Sustainable Built Environments & the UN's Sustainable Development Goals

The 17 Sustainable Development Goals (SDGs) of the United Nations are an urgent call for all developed and developing countries to join in a global partnership. The SDGs recognize that ending poverty and other deprivations must go hand in hand with strategies that improve health and education, reduce inequality and bo ...

Posted on 18/04/25

What is a Sustainable Built Environment?

Buildings are responsible for around 40% of energy and process-related global CO₂ emissions, 50% of all materials used, 33% of water consumption and 35% of waste. Other environmental impacts include resource depletion, pollution of air, water and soil, and biodiversity loss. By 2050, the global population is expected ...

Posted on 17/04/25

GOAL 8 Decent Work and Economic Growth

SDG 8 is the UN Sustainable Development Goal that recognizes the importance of sustained economic growth and high levels of economic productivity for creating well-paid quality jobs and achieving global prosperity for everyone. It promotes full and productive employment and decent work for everyone while eradicating f ...

Posted on 15/04/25

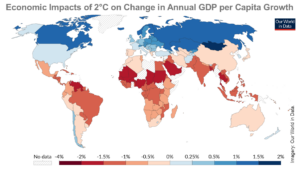

Forget Trump’s Tariffs – Climate Change could Wipe 40% off World Economy

The financial cost of climate change has been significantly underestimated, according to new research saying it could cut the world’s GDP by almost half. A recent study from UNSW Sydney factors in the full global reach of extreme weather, suggests the damage to the world’s economy could be far worse than previously th ...

Posted on 11/04/25

Recession and Climate Change

It is well known that recessions have economic and social impacts, while little attention is paid to their impact on the environment and ongoing climate action. Past recessions have shown that a slowdown in economic activity and a shift in government priorities can have both positive and negative impacts on climate ch ...

Posted on 10/04/25

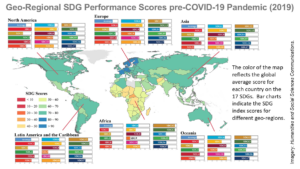

Challenges and Priorities in Achieving the Sustainable Development Goals: A Multi-Scaled Global Analysis

Understanding the challenges and priorities in achieving the Sustainable Development Goals (SDGs) requires consideration of the complexity and diversity within the SDGs, addressing the unique geographic and economic conditions, and reliable and comprehensive data for performance-based evaluation. While the SDGs Index ...

Posted on 09/04/25

Impact of March 2025 US Tariffs on Sustainability and Green Energy Progress

The US tariffs enacted by the Trump administration pose a significant threat to environmental sustainability in both the short and long term. In the near term, supply chains are disrupted, the cost for clean technologies increases, and adoption of solar power and electric vehicles is delayed. Over the longer term, tr ...

Posted on 08/04/25

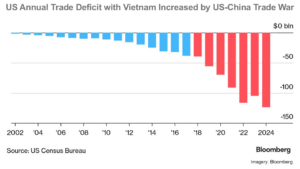

US Imposes 46% Tariff, Prompting Vietnam to Restructure Economy Toward Sustainable Development

Vietnamese Prime Minister Pham Minh Chinh stated during a monthly cabinet meeting on Sunday that Washington’s imposition of a 46% tariff on imports from Vietnam should be viewed as an opportunity for the Southeast Asian country to restructure its economy and diversify products and markets toward sustainable development ...

Posted on 07/04/25

Uncertainty and Climate Change: The IPCC Approach vs Decision Theory

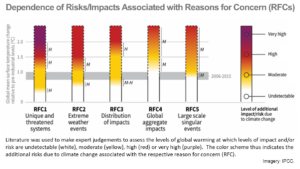

Uncertainties characterizing climate science, the economy and their interrelationships are a compelling argument for considering ambiguity and misspecification in the economics of climate change. The Intergovernmental Panel on Climate Change's (IPCC) approach to dealing with uncertainty is like risk as defined in deci ...

Posted on 03/04/25

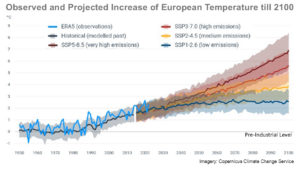

Could Climate Change Be Worse Than We Thought? New Models Say Yes

Scientists at EPFL (École Polytechnique Fédérale de Lausanne) have developed a climate model rating system and classified climate model outputs generated by the global climate community and included in the recent Intergovernmental Panel on Climate Change (IPCC) report. The tool evaluates the climate models and reveal ...

Posted on 03/04/25

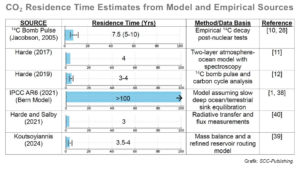

A Critical Reassessment of the Anthropogenic CO₂-Global Warming Hypothesis: Empirical Evidence Contradicts IPCC Models and Solar Forcing Assumptions

The Intergovernmental Panel on Climate Change (IPCC) attributes observed climate fluctuations primarily to anthropogenic CO₂ emissions and claims that these emissions have caused a net radiative forcing of about 1 Wm-² (watt per square meter) since 1750, resulting in a global temperature increase of 0.8 to 1.1 °C. Thi ...

Posted on 03/04/25

Synergy Solutions for Climate and SDG Action: Bridging the Ambition Gap for the Future We Want

Bottom-up data is key for addressing distributional impacts, as data on social dimensions often comes from local stakeholders. Good examples of localized data exist that help understand the disproportionate impact of climate change and disasters across sectors, populations, and geographies. Data collection methods, s ...

Posted on 27/03/25

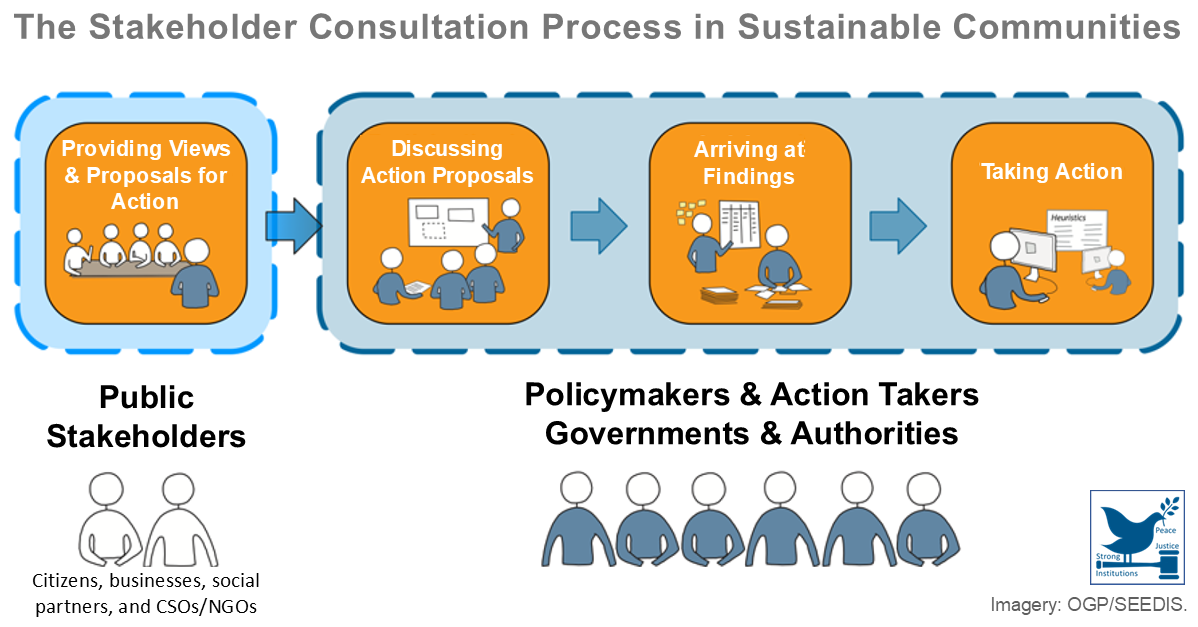

High-Level Political Forum on Sustainable Development

The High-level Political Forum on Sustainable Development (HLPF) is the central United Nations platform for the follow-up and review of the 2030 Agenda for Sustainable Development and its 17 Sustainable Development Goals (SDGs). The HLPF brings together ministerial and high-level representatives of governments, as wel ...

Posted on 26/03/25

‘I’m at a total loss for words at how hostility toward science has escalated in the U.S.’

“I’m at a total loss for words at how dramatically the rejection of knowledge, hostility toward science – and censorship – have escalated. […] But one thing that has already shocked me is this: a hurricane is such an immediate and tangible threat – there should be no ideological debate about it. [… ...

Posted on 25/03/25