Berg, Florian, Julian F. Kölbel, and Roberto Rigobon. "Aggregate Confusion: The Divergence of ESG Ratings". Review of Finance. May 23, 2022. https://doi.org/...

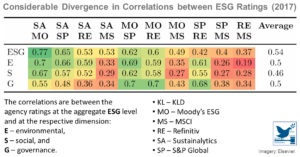

The divergence of ESG ratings creates uncertainty and represents a challenge for decision-makers, including investment managers and regulators. This ESG rating divergence makes it difficult to evaluate the ESG performance of companies, funds, and portfolios, which is their primary purpose. It also decreases companies’ incentives to improve their ESG performance. Companies receive mixed signals from rating agencies about what actions are expected and valued by the market, which will lead to underinvestment in ESG improvement activities. Thus, companies optimize for one rating while underperforming in other ESG dimensions and fail to improve the firm’s sustainability and intrinsic ESG performance.

The divergence of ESG ratings creates uncertainty and represents a challenge for decision-makers, including investment managers and regulators. This ESG rating divergence makes it difficult to evaluate the ESG performance of companies, funds, and portfolios, which is their primary purpose. It also decreases companies’ incentives to improve their ESG performance. Companies receive mixed signals from rating agencies about what actions are expected and valued by the market, which will lead to underinvestment in ESG improvement activities. Thus, companies optimize for one rating while underperforming in other ESG dimensions and fail to improve the firm’s sustainability and intrinsic ESG performance.

Posted on 25/07/23

Recent Abstracts

EMEA Real Estate Market Outlook 2020

The report takes a comprehensive look at the prospects for the EMEA real estate market in 2020. It provides a cautious economic and political outlook in the region amidst weakening global trading conditions, the capital markets in light of the accommodative policies of central banks that reinforce expectation of conti ...

Posted on 24/03/21